Astrology Case Study

Introduction:

Astrology is deeply rooted in India’s culture, and Astrotalk stands as the premier astrology platform in the country, spearheading the global expansion of India’s Vedic sciences. Established in 2017, Astrotalk has revolutionised the previously disorganised astrology market by creating a bridge between consulting astrologers and believers in astrology. Boasting a network of over 15,000 astrologers and serving a substantial base of 3 million active customers, Astrotalk leads the online astrology domain.

In contrast to traditional astrology practices, Astrotalk has streamlined the process, making it both time-efficient and cost-effective through its user-friendly interface. With a remarkable 100% year-on-year revenue growth over the past three years, Astrotalk has emerged as one of India’s most lucrative startups within the startup ecosystem.

Growth on the Road to IPO 2025

In October 2023, Puneet Gupta, the Founder and CEO of Astrotalk, revealed plans to pursue an IPO within the next two years, potentially valuing the company at over $1 billion. This announcement was groundbreaking considering that Astrotalk was only six years old and had been entirely self-funded. Intrigued by this unprecedented move, I decided to conduct a comprehensive growth case study on Astrotalk.

As a young player in the online astrology sector, Astrotalk is positioned to disrupt an industry traditionally dominated by incumbents with over two decades of experience, dating back to the early days of internet adoption in India.

This case study explores Astrotalk’s distinctive journey, shedding light on its organic growth strategies and the pivotal role they will play in achieving its ambitious target of generating revenue exceeding 2000 crore before the anticipated IPO in 2025-26.

How does Astrotalk work?

Astrotalk is an online platform where people who want advice from astrologers can connect with them easily. Here’s how it works:

- **Signing Up**: First, you create an account on Astrotalk by signing up.

- **Choosing a Consultation**: After signing up, you can pick from different types of consultations they offer, like Vedic astrology, Indian astrology, Tarot card readings, or talking directly with astrologers.

- **Picking an Astrologer**: You get to choose the astrologer you want to talk to based on their skills, what they specialise in, and what other people say about them.

- **Payment**: Once you’ve chosen, you pay for the service you want. Astrotalk usually has different ways you can pay to make it easy for everyone.

- **The Consultation**: You have your consultation through whatever way you picked, like a live chat, phone call, or email. It depends on what you prefer and what the astrologer can do.

- **Getting Advice**: During your consultation, the astrologer looks at things like your birth chart and planets to give you advice and answers your questions.

- **After the Consultation**: If you have more questions or need more help, Astrotalk is there to support you even after your consultation.

- **Sharing Feedback**: Once it’s done, you can leave feedback about your experience. This helps other people decide which astrologer to pick.

Overall, Astrotalk makes it easy for anyone to get astrological advice online by using technology to connect them with skilled astrologers.

Astrotalk’s Financials

Even though predicting the future is impossible, many Indians seek insights from fortune tellers, astrologers, and seers to gain some understanding of what lies ahead. This widespread interest in astrology explains why Astrotalk, an astrology marketplace, stands out among numerous startups struggling to turn a profit.

However, it’s important not to dismiss Astrotalk as merely capitalising on superstitions. According to Puneet Gupta, the founder and CEO, the platform serves more as a form of counselling or personalised guidance rather than blind faith in celestial predictions.

Previously, Gupta has stated that he was sceptical about astrology until he experienced a consultation in 2014 during a challenging period in his career, which turned out to be surprisingly beneficial.

This serendipitous event inspired the creation of Astrotalk, which achieved profitability for the first time in the fiscal year 2020 and has experienced rapid growth in recent years. Presently, the company envisions itself as the leading platform for astrology, often likening its trajectory to that of Uber’s disruptive influence in their respective industries.

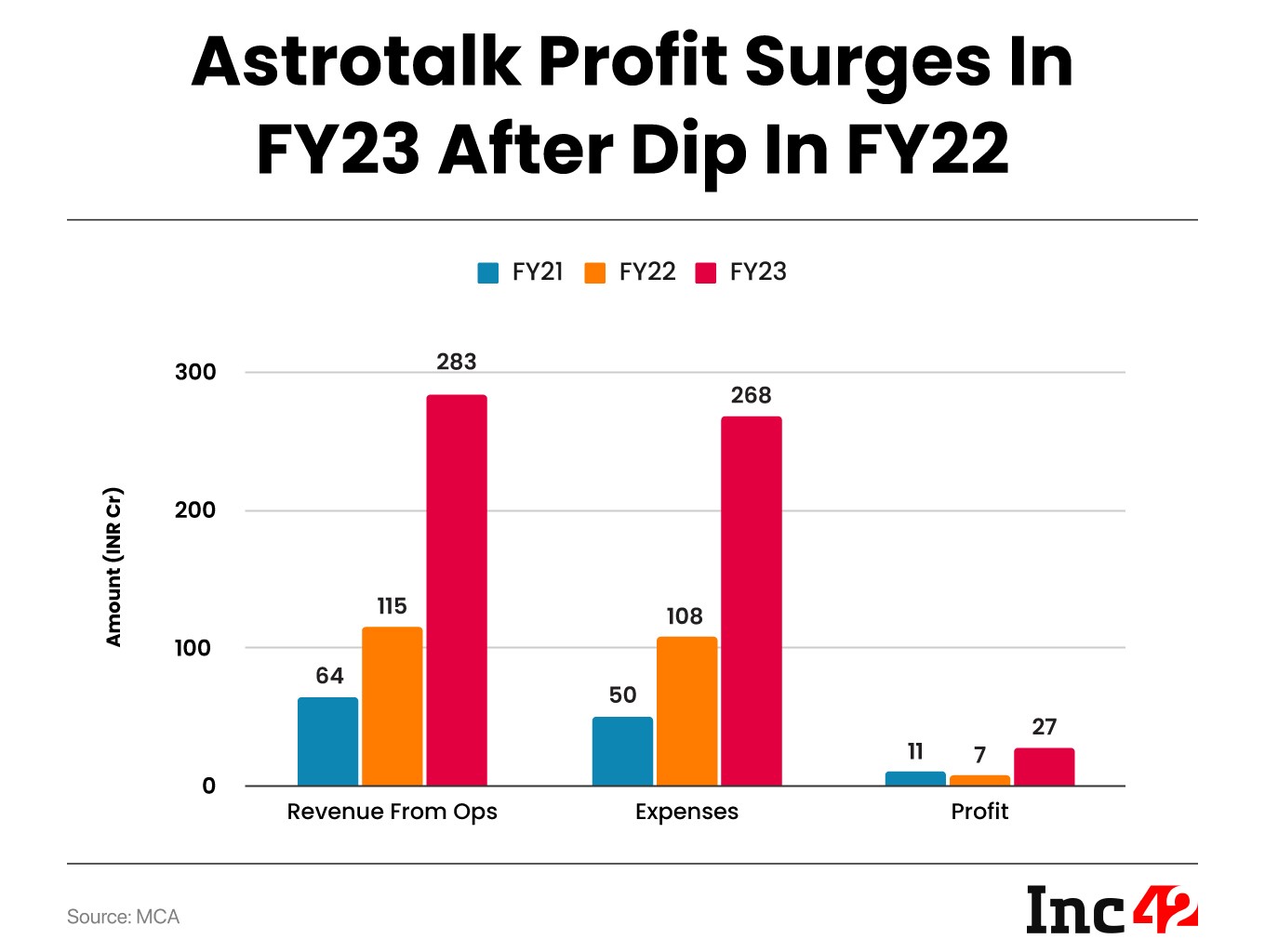

FY21 stood out as an unusual year, which explains the decline in profits during FY22. The surge in demand for online astrology consultations and related services was primarily driven by the COVID-19 pandemic in 2020-21.

Initially, AstroTalk experienced a revenue drop of around 10% during the first month of lockdown. However, throughout FY21, it witnessed a consistent month-on-month (MoM) growth rate of 10%. Within six months, daily revenue increased from INR 14 lakh to INR 19 lakh. Taking advantage of this momentum, the startup rapidly onboarded a large number of astrologers, facilitating connections with customers. This influx of astrologers boosted cash flow, enabling the company to expand its service offerings further.

Given the rapid expansion of this sector, Astrotalk anticipates reaching a revenue of INR 600 crore by the end of FY24, with a projected EBITDA margin of 16%, amounting to INR 100 crore.

Achieving such EBITDA efficiency is uncommon, though not unheard of. According to Astrotalk’s co-founder and chief business officer, Anmol Jain, the key lies in recognizing the critical importance of the service providers’ quality.

This emphasis is particularly pertinent in a field as sensitive as astrology, where the service often involves direct interaction between the provider and the customer, rather than a company delivering services to consumers.

Astrotalk’s Revenue (March 2024)

As of March 2024, Astrotalk boasts an impressive annual recurring revenue (ARR) of approximately INR 800 crores. ARR is a metric used to estimate the annual revenue generated from subscription-based services, providing insight into a company’s financial health and growth potential. Astrotalk’s ARR of INR 800 crores indicates a substantial and steady stream of revenue from its astrology consultation services, reflecting its strong market presence and customer demand.

Additionally, according to Puneet Gupta’s LinkedIn post, a significant portion of Astrotalk’s revenue, specifically 60%, is derived from marriage-related questions. This statistic sheds light on the prominent role that marital inquiries play in driving Astrotalk’s revenue stream. It suggests that a considerable portion of Astrotalk’s clientele seeks astrological guidance and insights specifically related to marriage, reflecting the societal importance and cultural significance placed on marital matters in India. This focus on marriage-related consultations underscores Astrotalk’s ability to cater to specific customer needs and preferences within the astrology market, contributing significantly to its overall revenue generation.

Business and Market Overview

The Product

Astrotalk makes most of its money by arranging private chats between customers and astrologers on its website. This is the main way they earn money. They set up these conversations to help people get personalised advice from astrologers who know their stuff. Astrotalk is all about giving top-notch service, making sure each person gets the help they need. By connecting customers directly with astrologers, Astrotalk makes sure everyone gets what they’re looking for while making a profit and staying at the top of the astrology game.

Target Audience

Astrotalk mainly serves young and ambitious people aged 20 to 35. These folks are often focused on their careers, personal growth, and dealing with life changes. Many of them live in big cities, moving there for job opportunities, education, or better lives.

Besides helping young folks, Astrotalk also works with astrologers who join their platform. According to Puneet Gupta, the founder, Astrotalk has over 10,000 astrologers onboard. This makes Astrotalk a big player in the astrology market, offering a wide range of services to users.

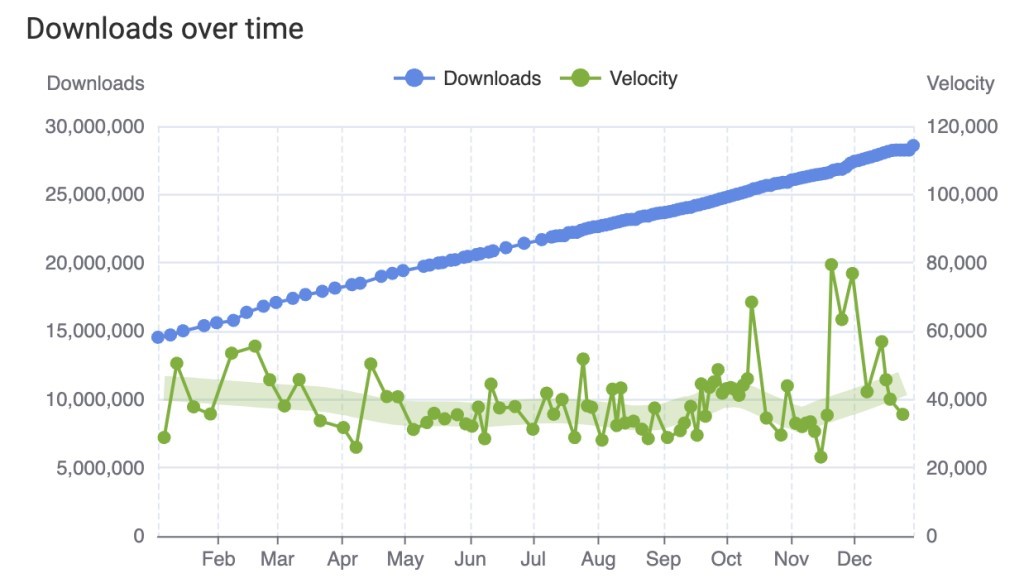

Astrotalk has reached some big milestones in terms of user engagement and popularity. They’ve been downloaded around 30 million times so far, with an average of 40,000 new downloads every day. This shows that a lot of people are interested in what Astrotalk has to offer.

On top of that, Astrotalk has been making a lot more money lately. In the past year, they’ve doubled their number of users and more than doubled their revenue. They’ve also increased their profits by more than four times. This shows that Astrotalk is doing a great job of making money and managing their business well.

Overall, Astrotalk is doing really well because they focus on young people, have a lot of astrologers, and keep growing their user base and profits. They’re seen as a top player in the astrology world, with a bright future ahead.

Funding

Astrotalk, founded in 2017, has become profitable, meaning it’s earning more money than it spends.

In August 2021, they got their first big investment called a seed round. Kunal Shah’s QED Innovation Labs gave them $800,000 to help Astrotalk grow.

By November 2023, Astrotalk was planning to raise even more money. They wanted to get $40 million in what’s called a pre-IPO round. This helps them prepare for their initial public offering (IPO), which is when a company sells its shares to the public for the first time.

In February 2024, Astrotalk successfully got $20 million in a Series A funding round. This time, the money came from a company called Left Lane Capital, based in New York. They valued Astrotalk at $200 million before adding any extra money.

All these investments together have given Astrotalk a total of INR 166 crores. This money has been really important for the company. It’s helped them grow, improve their technology, and reach more customers.

SEO Market Overview

Astrotalk’s competitive environment can be divided into two main categories: direct competitors and indirect competitors.

Direct competitors are companies that have a similar business model and target the same keywords as Astrotalk. These are other platforms or services that offer astrology consultations and cater to the same customer base. They directly compete with Astrotalk for customers and market share.

On the other hand, indirect competitors may have a different business model but still target the same keywords as Astrotalk. While they may not offer exactly the same services, they compete for the attention and interest of potential customers interested in astrology-related topics. These indirect competitors may offer related services or products that fulfil similar needs or interests.

Understanding both direct and indirect competitors helps Astrotalk to assess the competitive landscape comprehensively and adapt its strategies accordingly to maintain its position in the market.

Indirect competitors

Indirect competitors employ diverse business models that utilise various types of web pages to enhance their search engine optimization (SEO) strategies, contrasting with Course Hero.

For instance, in the news segment, platforms like Hindustan Times, India Today, and Dainik Bhaskar focus on delivering current events and breaking news to their audiences, aiming to capture traffic through timely and relevant content.

Similarly, lifestyle blogs such as Vogue and Elle cater to a different audience by offering fashion, beauty, and lifestyle-related articles, attracting readers through engaging and trend-focused content.

Although these competitors may not directly offer the same services as Course Hero, their utilisation of different page types and content strategies enables them to compete for online visibility and audience engagement in the digital landscape.

Direct competitors

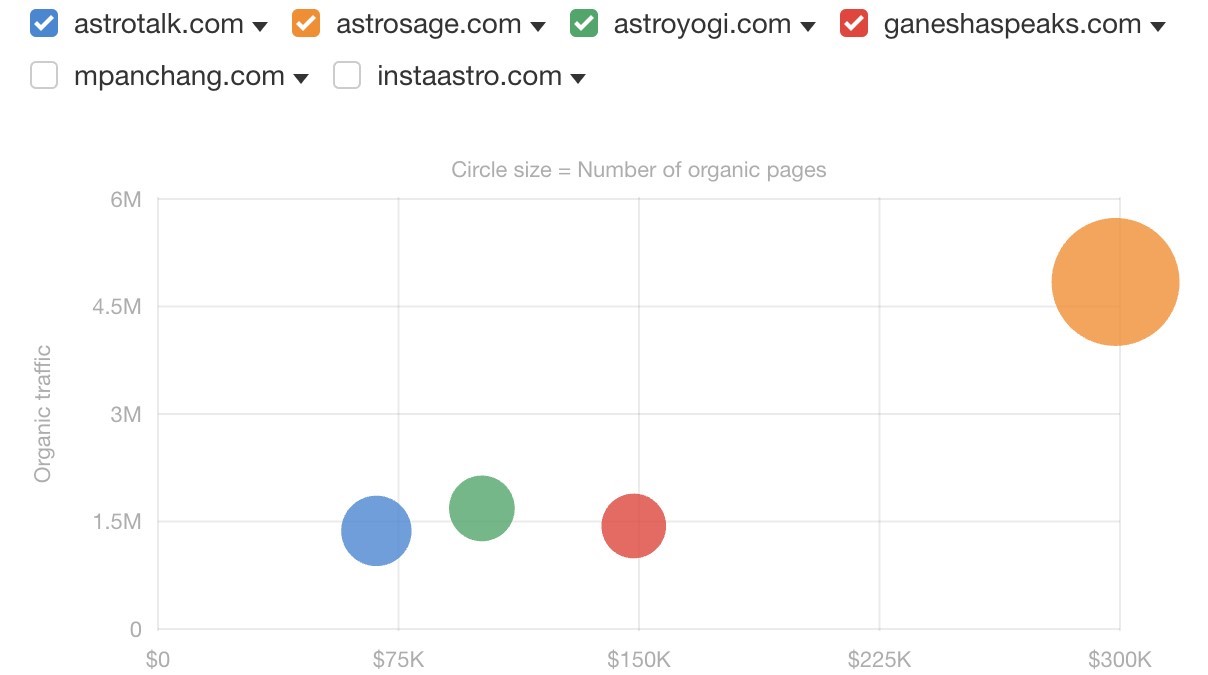

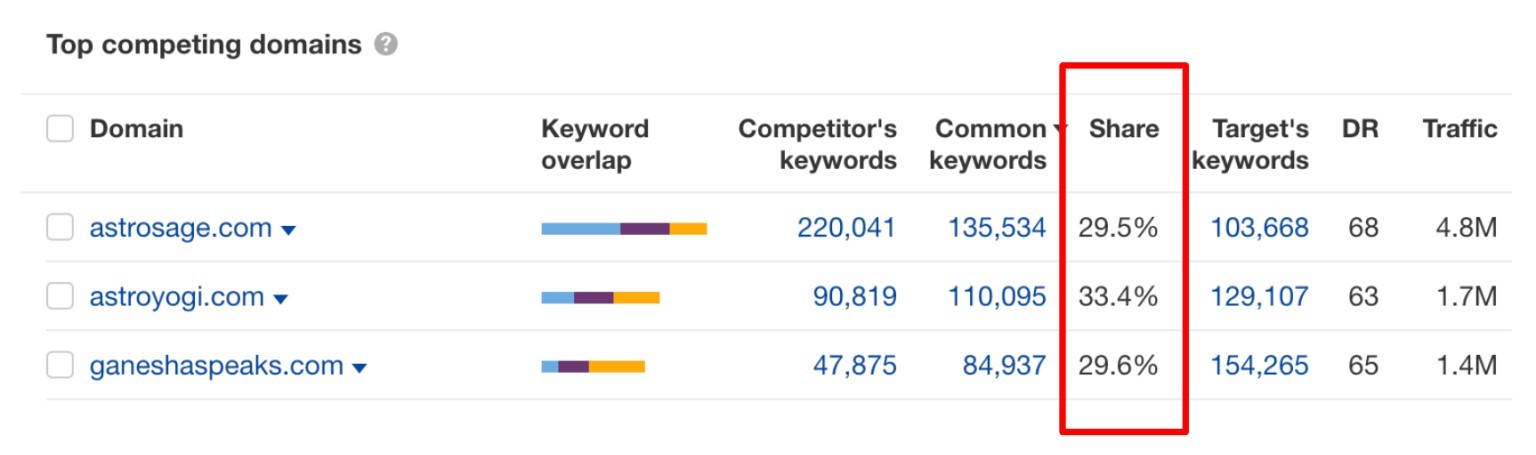

Astrotalk has some tough rivals in the astrology world, like Astrosage, Astroyogi, and GaneshaSpeaks. These platforms also connect people with astrologers for personal advice. You can talk to astrologers through chat, calls, or video calls.

One thing these competitors have in common is how they charge you. It’s usually based on how long you talk to the astrologer, so you only pay for the time you use. This way, you have control over your spending.

These platforms have lots of astrologers to choose from, so you can find someone who fits what you’re looking for, whether it’s their skills, specialty, or when they’re available.

Astrotalk needs to keep up with these rivals by offering great service, good prices, and a good experience for users. Understanding what these competitors are doing helps Astrotalk stay ahead in the astrology market.

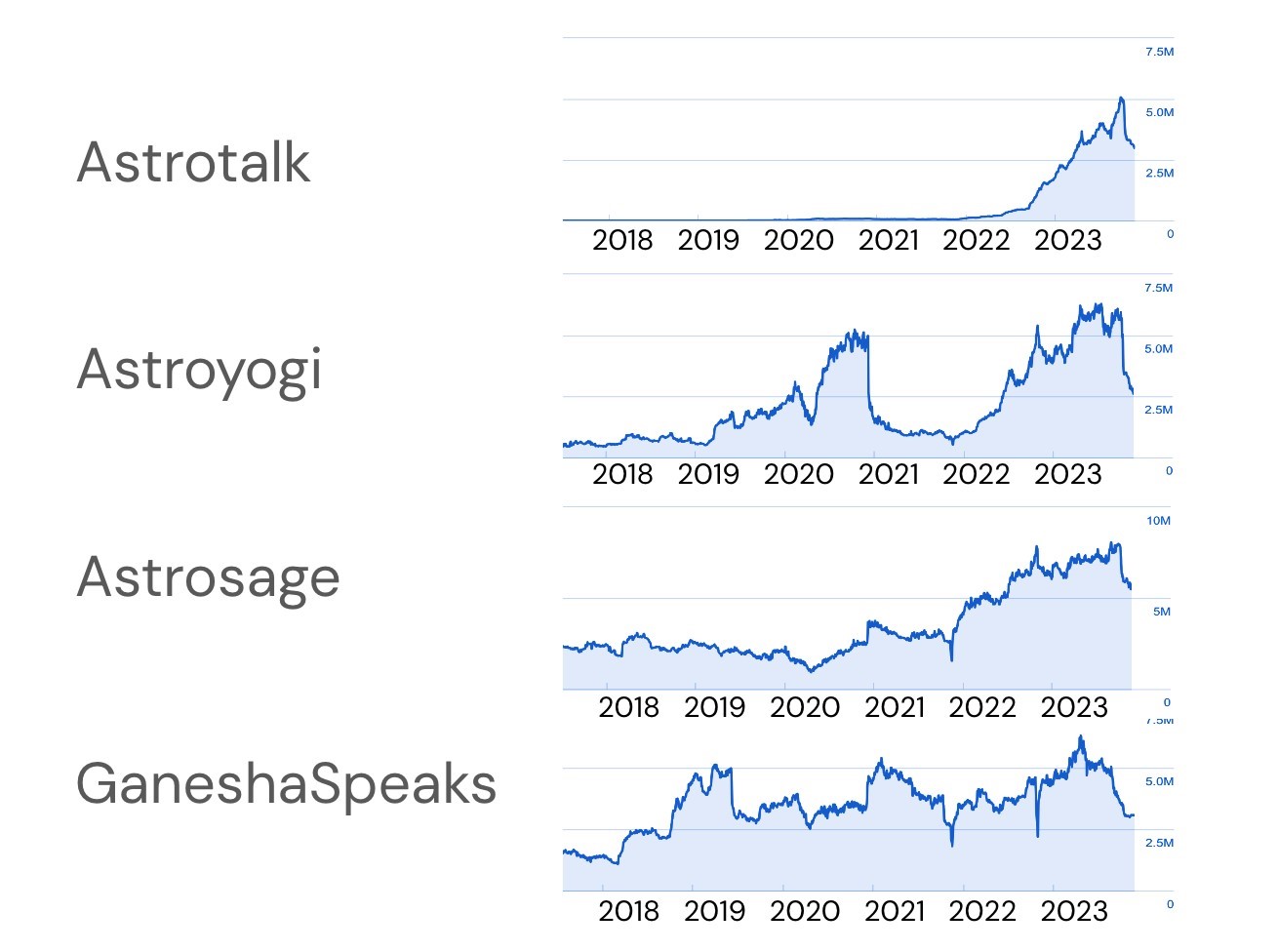

Organic Traffic Comparison

Astrotalk has shown impressive growth compared to its rivals, but the real challenge now is keeping up this momentum.

All three of Astrotalk’s main competitors have been using SEO to attract customers for much longer than Astrotalk has even been around.

Growth Challenges

Astrotalk follows a specific cycle to grow its customer base:

- They attract customers through advertisements, offering them their first session for free.

- Customers then connect with astrologers one-on-one and continue until they use up their free credits.

- Some of these customers choose to add more funds to their wallet for additional sessions.

- It takes about 6-8 months for Astrotalk to recover the cost of acquiring each customer.

- Around 80% of their revenue comes from customers who return for more consultations.

- They reinvest their profits back into performance marketing to keep the growth cycle going.

Growth Opportunities

To sustain its growth, Astrotalk needs to:

- Expand its presence in organic channels like SEO in a way that doesn’t follow a straight line, but rather grows rapidly.

- Branch out into other popular astrology-related practices, such as tarot card readings and psychic consultations, especially in regions where customers spend more on these services.

- Ensure that the reputation of its astrologers remains positive and trustworthy, as this is crucial for retaining and attracting customers.

Conclusion

In summary, Astrotalk has become a top choice for astrology advice by using new technology and focusing on what customers need. Since starting in 2017, it has grown a lot, making money and getting investments from big companies.

They’ve done well by paying attention to young people who are ambitious, building a group of loyal customers. Their partnerships, lots of experienced astrologers, and easy-to-use website have helped them get a big share of the market.

But now, they need to keep up this success in a competitive market. They’ll need to keep finding new ways to reach customers, offer more services, and make sure their astrologers keep a good reputation.

Overall, Astrotalk shows how technology can change traditional industries like astrology. As they keep changing and learning, they’re likely to keep growing and helping more people with astrology advice.