Zara Case Study

Introduction:

Zara, a fashion brand and chain of stores founded in 1975 by the Spanish group Inditex under Amancio Ortega’s ownership, has experienced remarkable growth over the past two decades. Alongside Zara, Inditex owns several other labels such as Bershka, Massimo Dutti, Pull and Bear, Stradivarius, Oysho, Zara Home, Zara Kids, and Uterqüe. Zara’s profits and store count have tripled during this period, solidifying its position as the third-largest retailer globally (Zhang, 2008).

With its headquarters in A Coruña, Spain, Zara boasts 3000 in-house designers who annually craft over 40,000 items, of which only 10,000 are selected for production (Li, 2009). Notably, more than 50% of Zara’s production occurs in Europe, setting it apart from competitors who rely heavily on Asian or South American production (Bruce and Daly, 2006). Zara’s agile approach to fashion is evident in its rapid design turnover—every two weeks on average—compared to its competitors, who typically change designs every two to three months. This results in a diverse range of about 11,000 distinct items per year across its thousands of stores worldwide, a stark contrast to competitors’ offerings of 2,000 to 4,000 items annually.

Central to Zara’s business success is its highly responsive supply chain, anchored by the automated distribution center known as “The Cube.” Zara targets women aged 24 to 35 by strategically locating stores in town centers and areas with high concentrations of this demographic. Short production runs create scarcity, driving a sense of urgency among customers to purchase quickly before items sell out. Consequently, Zara maintains minimal excess inventory and avoids significant markdowns on its clothing items. With 12 inventory turns per year compared to competitors’ 3 to 4, Zara’s stores place orders twice a week, driving precise factory scheduling and accurate forecasts.

Zara prices its clothing items based on market demand rather than manufacturing costs, and its short lead times for delivery combined with limited production runs enable a wide variety of styles and choices while creating a sense of urgency to buy. Zara sells 85% of its items at full price, significantly higher than the industry average of 60%. Additionally, Zara experiences only a 10% inventory unsold annually, contrasting with industry averages of 17 to 20%.

In Spain, customers visit Zara stores an average of 17 times per year compared to three times for competitors, largely due to the frequent turnover of clothing designs. This strategy encourages customers to visit stores and experience Zara’s unique fashions firsthand rather than relying solely on online browsing.

Sull and Turconi (2008) found that the fashion industry typically marks down around 50 percent of its inventory, while Zara only discounts about 15 percent of its items. This difference in markdowns contributes to Zara’s ability to consistently grow its sales and profits by over 20 percent per year. By September 2010, the Inditex group had expanded to own 4907 stores across 77 countries, with 38 located in Europe and 39 outside Europe. Zara is credited as a pioneer in Agile Supply Chain (ASC), with many researchers attributing its success to the efficiency of its ASC (Dutta, 2002; Tiplady, 2006; Sull and Turconi, 2008; Zhang, 2008). Zhang (2008) outlines four main components of Zara’s supply chain process:

- Product Organization and Design

- Purchase and Production

- Product Distribution

- Sales and Feedback.

Fast Fashion Concept:

The concept of Fast Fashion revolves around the swift manufacturing of affordable clothing that reflects current fashion trends. It prioritizes efficient supply chain practices and quick production cycles, allowing retailers such as Zara to introduce new collections multiple times per year, often on a weekly basis. This approach stands in stark contrast to traditional fashion industry norms, which typically involve lengthy production timelines, limited collections, and higher price points.

Quick Stats About Zara | |

Founder | Amancio Ortega and Rosalia Mera |

Year Founded | 1975 |

Origin | Artexio, Spain |

No. of Employees | 75,000 |

Company Type | Public |

Market Cap | $115.09 Billion |

Annual Revenue | €18.021 Million |

Net Profit | €14.129 Million |

Products

Zara offers a range of products including men’s, women’s, and children’s clothing (Zara Kids), all of which are tailored to reflect current consumer trends. The brand operates a highly responsive supply chain, delivering new products to stores twice a week. From design to delivery, the process takes about ten to fifteen days, with all clothing passing through the distribution center in Spain. At the distribution center, new items undergo inspection, sorting, tagging, and loading onto trucks for delivery. Typically, clothing reaches stores within 48 hours. Zara produces over 450 million items annually. As part of the Inditex group, which is the world’s largest fashion group, Zara operates more than 7,400 stores in 202 markets worldwide, including 49 online markets. In 2019, Inditex reported revenues of USD 23.4 billion.

- Clothing

- Accessories

- Footwear

- Swimwear

- Beauty

MANUFACTURING AND DISTRIBUTION

Reportedly, Zara has streamlined its production process to bring new products from concept to stores in just one week, a stark contrast to the industry’s six-month average. With approximately 40,000 designs developed annually, Zara carefully selects around 12,000 new designs for production each year. Interestingly, Zara does not invest in traditional advertising, opting instead to allocate a portion of its revenues towards opening new stores.

In 1980, Zara established its own factory in La Coruña, leveraging a reverse milk-run-type production and distribution system pioneered by Toyota Motor Corp., known as the just-in-time (JIT) system. This approach enables self-containment across material sourcing, manufacturing, product completion, and global distribution within a matter of days. Most of Zara’s products are manufactured in nearby countries like Spain, Portugal, Turkey, and Morocco, with half of its merchandise produced in company-owned factories in these regions.

Zara’s ability to design and deliver new products within four to five weeks, and modify existing items in as little as two weeks, shortens the product life cycle and enhances its responsiveness to consumer preferences. If a design fails to perform well within a week, Zara swiftly withdraws it from stores, cancels further orders, and pursues new designs. By closely monitoring fashion trends, Zara encourages repeat visits from its customer base.

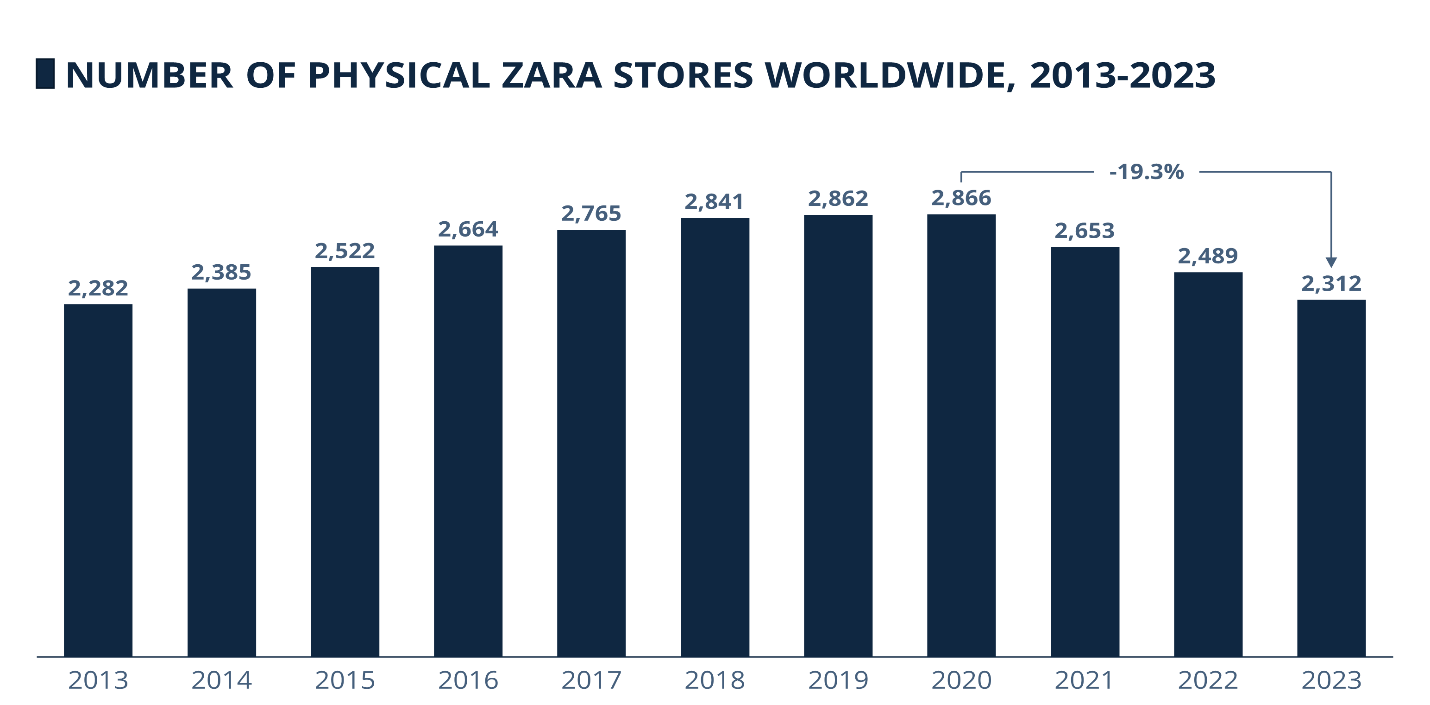

As online shopping continues to reshape the retail landscape, Zara is adapting by shifting focus towards online channels and planning to open fewer, but larger, stores in the future. With aggressive expansion efforts spanning across global markets, Zara now operates 2,264 stores in leading cities across 96 countries. From its humble beginnings as a small store in Spain, Zara has emerged as the world’s largest fast-fashion retailer and the flagship brand of Inditex. Its founder, Amancio Ortega, ranks as the sixth richest individual globally according to Forbes magazine.

NON-TOXIC CLOTHING

In 2011, Greenpeace initiated discussions with Zara to address the use of toxic substances in clothing production. This dialogue led to Greenpeace publishing its “Toxic Threads: The Big Fashion Stitch-Up” report in November 2012, as part of its Detox Campaign, which aimed to highlight companies employing toxic substances in their manufacturing processes. Just nine days after the report’s publication, Zara made a commitment to eliminate all hazardous chemical releases from its supply chain and products by 2020. Zara’s pledge marked a significant step forward, making it the largest retailer globally to champion the Detox Campaign and transition to completely toxic-free production practices.

EXPLOITATION AND CHILD LABOUR

Regarding concerns about exploitation and child labor, in 2016, BBC News reported evidence of such issues in factories in Turkey linked to Zara. Zara responded by acknowledging some issues at one factory in June 2016. However, rather than immediately addressing these concerns, Zara granted a six-month period to resolve them.

Zara’s impact on the fashion industry: Business Model

Zara’s business model and strategy has had a huge impact on every aspect of the fashion industry

Agile Supply Chain: Zara’s vertical integration allows it to handle everything from design to distribution in-house, giving the brand agility to swiftly respond to new trends and changing customer demands.

Speed to Market: Zara’s remarkable ability to bring new designs to stores within weeks, rather than months, sets a new benchmark in the fashion industry. This rapid turnaround enables Zara to capitalize on emerging trends while they are still in vogue, captivating fashion-conscious consumers.

Consumer-Focused Approach: Zara prioritizes understanding consumer preferences by actively soliciting feedback and analyzing sales data. This customer-centric approach ensures that Zara’s products align closely with what customer’s desire.

Affordable Fashion: Zara democratizes fashion by offering stylish clothing at affordable price points, making high-quality fashion accessible to diverse demographics. This affordability encourages consumers to make more frequent purchases and invest in their wardrobe.

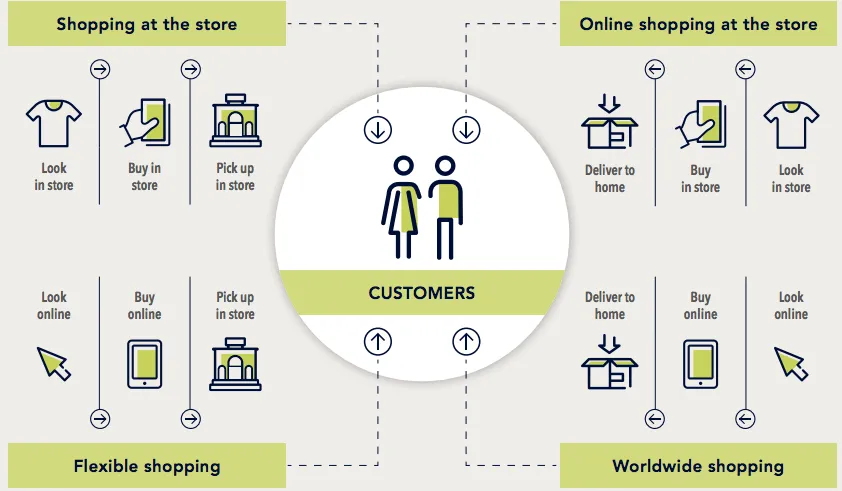

In-Store Experience and E-Commerce: Zara’s physical stores offer a unique shopping experience characterized by updated information and a sense of exclusivity for popular products. Additionally, the brand has invested in e-commerce platforms to provide convenient online shopping options for its customers.

Global Expansion: Zara’s success has enabled it to expand globally, with stores in major cities worldwide. Its widespread presence has significantly impacted fashion trends and consumer behavior across different regions.

Sustainability Efforts: Amid increasing concerns about the environmental impact of fast fashion, Zara is actively working to integrate sustainability practices into its operations. This includes eco-friendly manufacturing processes and initiatives aimed at developing a more sustainable supply chain.

Zara’s business model revolves around offering medium-quality fashion clothing at affordable prices. Vertical integration and rapid responsiveness are central to Zara’s success; without them, the company would not have achieved its current standing. The business process is carefully orchestrated, encompassing functions such as design, sourcing, manufacturing, distribution, and retailing, all managed in-house. This integrated approach has fueled Zara’s impressive growth rate. However, like any model, it has its vulnerabilities. Zara’s reliance on its own distribution center and manufacturing facilities poses potential risks. This aspect will be explored further in the following discussion.

Zara maintains a keen understanding of its customers’ preferences through continuous monitoring throughout the year. The company employs a team of designers, often fresh graduates from fashion schools, who are well-equipped to translate customer desires into tangible designs. Zara operates with a lean approach, producing limited quantities of each item from the approximately 11,000 designs created by its in-house team. By carefully curating its offerings, Zara mitigates the risk of overproduction and subsequent losses. For items with a limited seasonality, such as miniskirts tailored for the European summer, Zara ensures a brief availability window to match demand. Conversely, garments with year-round appeal and stable trends are outsourced to Asia, where production costs are lower. This outsourcing strategy is particularly advantageous for items with extended shelf lives. Remarkably, Zara’s streamlined operations allow for a swift turnaround, with the entire process from design to finished product taking only around four weeks.

Zara’s ability to swiftly adapt to market trends in the fashion industry is a significant advantage. Unlike traditional retailers, Zara can quickly adjust its strategy to align with prevailing trends. Typically, it takes 8 to 12 months for conventional retailers to forecast trends, develop styles, and send them into production. In contrast, Zara’s agile approach allows it to modify its schedule rapidly in response to changing market trends. This agility gives Zara a competitive edge, as other retailers struggle to keep pace and often miss out on opportunities. Even if a particular style doesn’t sell well, Zara can efficiently offload excess inventory through discount sales. Moreover, Zara’s low-volume manufacturing strategy minimizes the quantity of excess inventory, resulting in fewer markdowns compared to the industry average. This approach has proven highly effective for Zara, enabling it to maintain a lower rate of discount sales than its competitors.

Zara’s business model excels by staying ahead of fashion trends, effectively turning trends into profitable ventures. The company’s strategy is akin to having the “Midas touch,” as they consistently capitalize on market trends. They maintain a predominantly young and fashion-savvy staff, who serve as both employees and trendsetters. When a particular item sells well in one store, management swiftly replicates its success by stocking the same item in other locations. Crucially, Zara deliberately maintains limited stock of most items, creating a perception of scarcity that drives consumer demand. This scarcity mentality motivates consumers to make purchases, fueling Zara’s success further.

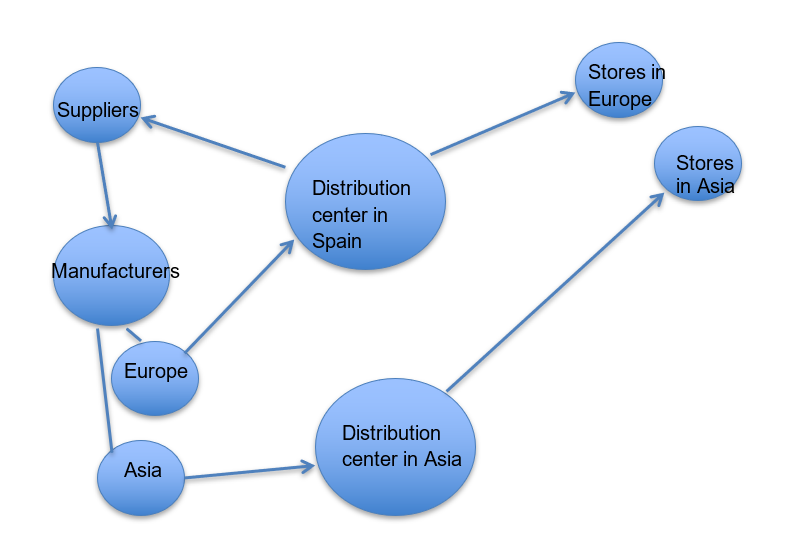

Zara’s primary distribution hub is located in Spain, housing its largest distribution center. Additionally, smaller distribution centers are situated in countries like Argentina, Brazil, and Mexico. However, the main issue with the distribution center lies in its capacity limitations. Occupying approximately 500,000 square feet, it can only process around 60,000 folded garments per hour. To address this constraint, Zara must either invest in a new distribution center or expand its existing operations to increase efficiency. Nonetheless, Zara benefits significantly from vertical integration, allowing it to manufacture and distribute its own products independently, without reliance on external suppliers.

Facilitating the movement of goods is Zara’s proprietary railway network, streamlining transportation to its distribution center. Once products are ready, they are promptly shipped out, with a shipping schedule of twice a week. European stores typically receive goods within 24 to 36 hours, while other destinations receive them within two days. This system ensures a high level of accuracy in shipments, contributing to customer satisfaction.

Moreover, Zara’s outlets swiftly display new arrivals upon arrival, enabling customers to access fresh stock promptly. To facilitate organization, clothes are coded by color, aiding staff in placement and simplifying the shopping experience for customers.

Problems with Zara’s Business Model

Zara is currently grappling with several challenges that could potentially impact its future stability. Despite maintaining a robust and competitive business system, the company remains vulnerable to significant downturns. One of Zara’s primary strengths lies in its efficient economies of scale and well-developed distribution system, which have fueled its sustained growth. International expansion has played a crucial role in this growth trajectory. However, Zara’s expansion in the international market may face limitations due to its heavily centralized logistics model. As the company seeks to expand its distribution network and increase capacity, it will encounter obstacles given its reliance on a single base in Spain. Expanding beyond this centralized setup presents logistical complexities and operational hurdles for Zara.

Zara’s plans for international expansion may be hampered by these challenges. While the company has a strong presence in Europe, relying solely on this market is not sustainable for long-term growth. Although Zara operates in other countries, its footprint outside of Spain is comparatively limited. There is ample opportunity for Zara to target the North American market, where its presence is not as significant relative to the region’s size. However, entering this market entails dealing with intense competition, diverse consumer preferences including demand for plus-sized clothing, high operational costs, and a mature retail landscape. To succeed in North America, Zara must develop a robust strategy that allows it to compete aggressively.

South America presents another potential market for expansion, but geopolitical instability in the region poses a risk to profitability. The Middle East offers a stable market where Zara already has a foothold, albeit small. However, political unrest and geopolitical tensions could jeopardize investments in this region. While certain countries in the Middle East hold promise, the overall market size is limited compared to other regions.

Alternatively, Zara could explore opportunities in Southeast Asian and South Asian markets, which boast significant growth potential. These regions offer untapped consumer markets and expanding middle-class populations, making them attractive targets for Zara’s expansion efforts.

Competitors of Zara

They are a boatload of fashion brands in the industry. However, the top 5 major competitors are as follows –

- H&M

- Forever 21

- Boohoo

- Mango

- Marks and Spencer’s

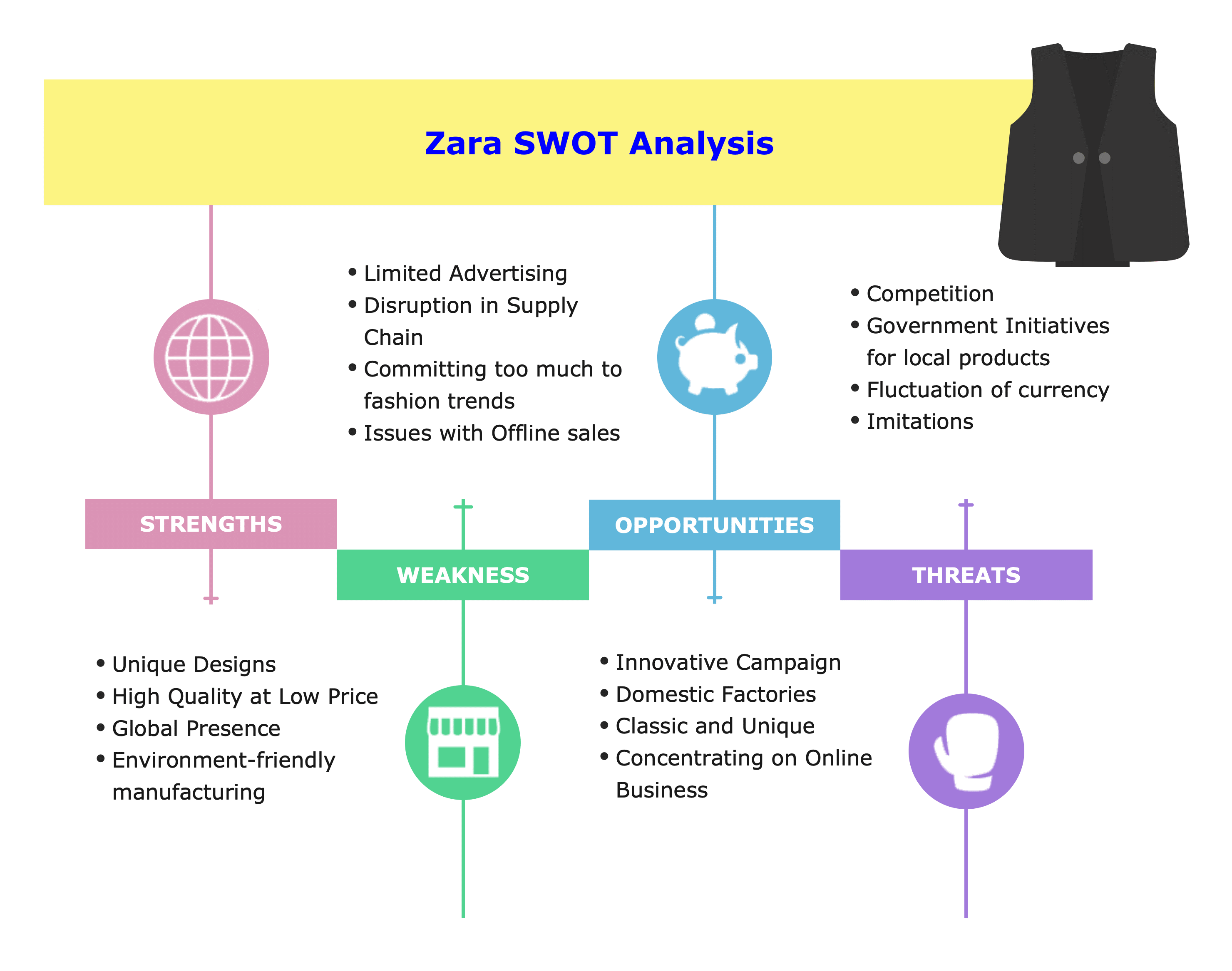

SWOT Analysis of Zara

A SWOT analysis of a brand like Zara offers valuable insights into its Strengths, Weaknesses, Opportunities, and Threats, which are essential for understanding its business dynamics and enhancing problem-solving skills. Let’s delve into the details:

Strengths of Zara:

Starting with Zara’s strengths, these are the unique capabilities that give the organization an edge in capturing market share, attracting customers, and maximizing profits.

Pioneer Advantage: Zara excels in instant fashion, with a streamlined process of designing, producing, and selling garments within just three weeks. This pioneering approach in supply chain management gives Zara a strategic advantage.

Stores: Zara boasts a remarkable global presence, with retail outlets in 96 out of the 202 countries it operates in. With 2,249 stores worldwide, Zara holds the top spot in the fashion retail industry.

Supply Chain: Zara’s agile supply chain updates its collections twice a week, delivering to any region within 48 hours. Supported by ten logistic centers, Zara’s efficient distribution system ensures rapid delivery worldwide.

Team of Designers: Zara employs a team of 700 trained designers who swiftly transform customer preferences into designs. With a production cycle of just three weeks, Zara can swiftly bring designs from concept to shelves.

Investment in Online Retail: Inditex, Zara’s parent company, is investing $3 billion to enhance its online sales. This investment aims to create an engaging online shopping experience and integrate physical and online retail channels, with a goal to generate a quarter of revenue from online sales by 2022.

Zara’s success lies in its adeptness in digital marketing. However, the fast fashion model also poses environmental and ethical challenges, as discussed in the weaknesses section to follow.

Weaknesses of Zara

Zara’s rapid turnover of fashion trends every three weeks has been a key factor in its success, distinguishing it from other fashion brands. However, this approach also presents significant weaknesses for the company. Let’s explore these weaknesses in more detail:

Instant-fashion Trends: While Zara’s ability to quickly adapt to changing fashion trends has propelled it to the top of the industry, it also faces challenges in balancing sustainability with the demands of instant fashion. As sustainability becomes increasingly important to consumers and policymakers, Zara must find ways to address this issue while maintaining its rapid fashion turnover.

Physical Store Dependence: Zara’s heavy reliance on physical stores has become apparent, particularly in light of the COVID-19 pandemic. While the company has made strides in boosting online sales, they still only account for 89% of pre-pandemic levels. This underscores the need for Zara to diversify its sales channels and reduce dependency on brick-and-mortar stores.

Expansion to the US and Asia-Pacific: Despite being the largest apparel market globally, Zara has a relatively small presence in the United States, with only 4.4% of its total outlets located there. Similarly, its footprint in the Asia-Pacific region is limited, despite its significant share of the global apparel market. Expanding further into these regions presents opportunities for growth, but Zara must overcome the challenges of establishing a stronger presence.

Ethical Workplace Standards: While Zara has implemented a strict code of conduct for its suppliers, there are gaps in enforcement, as highlighted by reports of poor treatment of employees in certain regions, such as Myanmar. Addressing these ethical concerns is essential for maintaining Zara’s reputation and consumer trust.

Prediction Aided by AI Systems: Zara’s investment in AI-enabled market trend prediction systems holds promise for enhancing its forecasting capabilities and meeting customer demands more effectively. However, the system is still in the testing phase, and Zara must ensure its successful implementation to gain a competitive edge in the market.

Opportunities For Zara:

Zara’s agility in responding to fashion trends presents numerous opportunities for the brand to further enhance its market position. Let’s explore some of these opportunities:

Rapid Cycle: Zara’s high frequency of customer visits, averaging 17 times per year, demonstrates the effectiveness of its rapid delivery cycle. With the ability to create and capitalize on trends within just two to three weeks, Zara has the opportunity to further shorten these cycles, staying ahead of competitors and meeting evolving consumer preferences swiftly.

Personalization: Leveraging AI technology enables Zara to gather and analyze customer data, facilitating personalized recommendations and experiences. By harnessing this technology effectively, Zara can enhance customer engagement and loyalty, ultimately driving sales and revenue growth.

Sustainability: With a growing demand for sustainable and environmentally friendly products, particularly among Millennials and Gen Z consumers, Zara has the opportunity to address this expanding market segment. By integrating sustainable practices into its operations and offering eco-friendly product lines, Zara can attract and retain environmentally conscious consumers.

Reselling: The booming resale market presents an opportunity for Zara to capitalize on the trend towards circular fashion and reduce waste. By implementing a resale platform within its existing infrastructure, Zara can cater to customers’ desire for more sustainable consumption while also generating additional revenue.

Influencer Marketing: Influencer marketing has proven to be highly effective in promoting lifestyle brands like Zara. By partnering with influencers and leveraging social media platforms, Zara can reach a wider audience and drive engagement with its target market. Investing in influencer marketing initiatives, such as collaborative campaigns with micro-influencers, can further enhance Zara’s brand visibility and appeal.

Threats for Zara

In the final part of Zara’s SWOT analysis, we’ll explore some of the challenges the brand may encounter. While traditional competitors like H&M remain a significant threat, Zara now faces increasing competition from online-based rivals, adding to its concerns.

Competition: Emerging players like Shein, a prominent online fast-fashion retailer based in China, pose a significant threat to Zara. Shein’s rapid growth, evidenced by its 10.3 million app downloads compared to Zara’s 2 million, highlights the intense competition Zara faces in the digital realm.

Price Wars: Zara’s fast-fashion model, offering trendy clothing at affordable prices, is facing intense price competition from competitors seeking to undercut its market share. While Zara’s brand loyalty is strong, pricing battles could erode its competitive edge.

COVID-19 Pandemic: The global pandemic severely impacted Zara’s operations, with Inditex reporting a 44% decline in revenue in the first quarter of 2020. The closure of 88% of its stores due to lockdown measures significantly contributed to the revenue downturn, highlighting the brand’s vulnerability to external shocks.

Regulatory Challenges: Zara’s operations in Spain were heavily affected by government-imposed lockdowns during the pandemic. With restrictions potentially resurfacing in regions like Europe and India amid concerns of a third wave, Zara may face further disruptions to its manufacturing and distribution operations, impacting its ability to meet consumer demand.

Conclusion and Suggestions

In conclusion, Zara has emerged as a dominant force in the fashion industry, with its founder ranking as the wealthiest individual in Spain. The company’s success can be attributed to strategic decision-making and adaptability, which have laid a solid foundation for growth.

While Zara’s current strategies have proven effective, it is imperative for the company to continuously evolve in response to changing market dynamics. Introducing strategic changes and refining objectives will be essential to sustaining growth and maintaining excellence.

However, it is advisable for Zara to approach strategic changes cautiously and not implement them all at once. Instead, a phased approach, where changes are introduced gradually and responses are carefully analyzed, would be more prudent. Thorough evaluation of circumstances should precede the implementation of any decision to ensure its effectiveness.