Walmart Case Study

Introduction:

Walmart stands as one of the globe’s largest retail giants, tracing its roots back to 1962 when Sam Walton founded it. With its headquarters based in the United States, Walmart prides itself on delivering consistent discounts, dedicated customer care, and efficient service.

The company’s ambitious agenda includes expanding into major urban centers and establishing a widespread presence across the globe. Walmart’s retail landscape encompasses four primary divisions: Walmart Supercenters, Discount Stores, Neighborhood Markets, and Sam’s Club warehouses, drawing in over 100 million customers worldwide.

However, Walmart’s rapid expansion often spells trouble for small-scale merchants and local communities in America. As the retail behemoth swoops into towns offering cut-rate deals and superior service, it creates stiff competition, often leading to the demise of smaller businesses. This aggressive approach, fueled by formidable purchasing power and relentless marketing, gradually solidifies Walmart’s position as the leading retailer globally.

Yet, this success comes at a cost, as Walmart’s growth is marred by accusations of disregarding local culture and language, thereby alienating communities and local businesses.

History of Walmart

The history of Walmart, an American discount department store chain, began in 1950 when businessman Sam Walton purchased a store from Luther E. Harrison in Oklahoma City, Oklahoma, and opened Walton’s 5 & 10.[1] The Walmart chain proper was founded in 1962 with a single store in Rogers, expanding inside Oklahoma by 1968 and throughout the rest of the Southern United States by the 1980s, ultimately operating a store in every state of the United States, plus its first stores in Canada, by 1995. The expansion was largely fueled by new store construction, although the chains Mohr-Value and Kuhn’s Big K were also acquired.

Timeline Events Of Walmart company

Here’s a paraphrased timeline of significant events in Walmart’s history:

– 1960: Sam Walton launched his inaugural discount store in Rogers, Arkansas.

– 1981: Walmart claimed the title of America’s largest company.

– 1981: Following this milestone, expansion led to store openings in a small Louisiana town.

– 1983: Stores were established in Pawhuska and Oklahoma.

– 1986: Walmart pledged to restore over 4,000 jobs in American communities.

– 1989: A campaign emphasizing environmental consciousness was initiated.

– 1990: Opposition from activist groups against store expansion emerged.

– December 31, 1990: Store closures were executed in Louisiana.

– November 5, 1991: A new store was inaugurated in Iowa City.

– October 6, 1998: Founder Sam Walton established the Walton Family Charitable Support Foundation.

– June 1999: Walmart acquired the British ASDA Chain, expanding its presence across the United States.

– 2001: Walmart attained the status of the world’s largest retailer, recording sales of $191 billion.

– July 2003: Store openings commenced in Beijing, China, with the count now at 22 and growing.

– 2006: Store closures were carried out in Germany.

– July 2007: Walmart operated over 2,500 retail units internationally, with a workforce exceeding 500,000.

– 2007: By year-end, net sales reached $45 billion.

– 2008: Walmart launched its wholesale facility in India, marking the initial step towards retail outlet operations in the country.

– 2018: Acquisition of Flipkart for $16 billion secured Walmart a 77% stake in India’s leading online retailer.

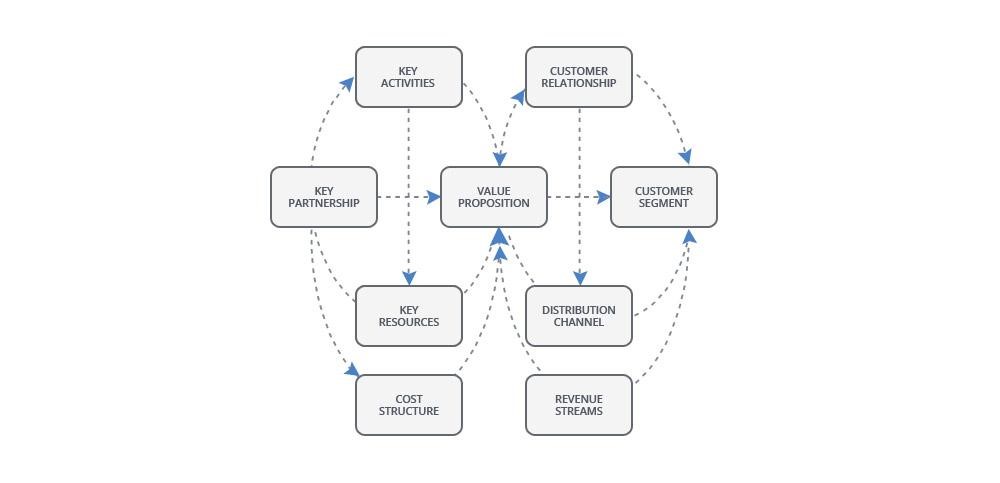

Business Model Of Walmart

Successful companies often adopt diverse business models that evolve over time. Walmart’s business model revolves around cutting out the middleman in distribution channels. By eliminating this intermediary, Walmart aims to offer products to consumers at lower costs, thus passing on the benefits of reduced prices. The core objective of Walmart’s business strategy is to penetrate every market segment and establish dominance by consistently offering products at competitive prices.

Central to Walmart’s marketing strategy is a focus on leading in pricing, maintaining competitiveness, and delivering a superior customer experience under the motto of “Everyday Low Price.”

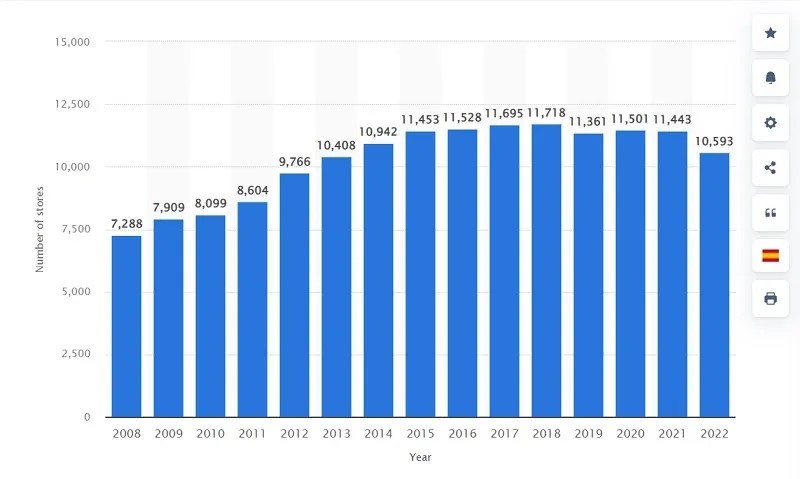

At the heart of Walmart’s business model lies its commitment to price leadership. By consistently offering the lowest prices, Walmart has established itself as a leader in the US retail market. Presently, the company operates over 11,000 physical stores across 28 countries and maintains ecommerce platforms in more than 11 nations. Walmart’s current focus is on delivering a seamless shopping experience for customers, whether they are shopping via mobile devices or in-store. The brand refers to its workforce of approximately 2.3 million as “associates,” with 1.5 million of them based in the United States. This discussion delves into Walmart’s business strategy and the notable successes it has achieved as a result.

Everyday Low prices

At the core of Walmart’s business strategy lies its commitment to offering everyday low prices. The brand’s extensive product range is consistently priced competitively, catering to the preferences of millennial consumers who prioritize convenience, affordability, and product quality. Walmart’s strategy is to entice customers with low prices and retain their loyalty through ongoing discounts and shopping convenience across various product categories, from groceries to entertainment and beyond.

The company’s unwavering focus on providing the lowest prices has become a significant competitive advantage, resonating strongly with price-conscious American consumers. This obsession with affordability has deepened over time, driving Walmart to seek further growth and market share expansion through aggressive pricing strategies.

In 2017, Walmart intensified its efforts to maintain its price leadership position by investing heavily in price reductions, resulting in a substantial revenue increase exceeding $485 billion. This strategic move not only solidified Walmart’s reputation as a retailer offering the best value but also contributed to industry-wide price deflation.

As competition in the retail sector intensifies, Walmart remains ahead of the curve by not only prioritising price competitiveness but also enhancing customer convenience. The company has elevated its operational standards and customer service across its stores, bolstering its reputation as a customer-friendly brand.

In summary, Walmart’s sustained growth can be attributed to its relentless focus on offering low prices, coupled with its commitment to enhancing customer convenience and satisfaction. These factors continue to drive Walmart’s dominance in the retail market and position it for continued success amidst increasing competition.

Four Important factors driving growth of Walmart

Investopedia highlights four key factors that have fueled the growth of Walmart’s contemporary retail model. While the brand’s foundational philosophy remains consistent, Walmart has continually modernised its operations, enhancing their role within its efficient model over time.

- **High Sales Volume**: Enabled by a vast customer base and expansive scale of operations, Walmart achieves significant sales volumes, driving its growth.

- **Efficient Supply Chain**: Walmart boasts a highly efficient supply chain system designed to maximise productivity and minimise costs, ensuring smooth operations and timely delivery of goods.

- **Low Operational Costs**: The company maintains low operational and overhead costs, allowing it to remain competitive and pass on savings to customers through lower prices.

- **Bargaining Power with Suppliers**: Leveraging its considerable scale, Walmart negotiates with suppliers to secure the best possible prices for goods. This ability to wield bargaining power is a crucial strength for a large-scale retailer and underpins its competitive advantage in pricing.

These factors collectively contribute to Walmart’s success in maintaining its position as a leading retailer, embodying efficiency, affordability, and scale in its operations.

Walmart has three important segments

Walmart U.S

Walmart U.S. operates within the United States, offering customers a wide range of products and services accessible both in-store and online. Through its website and mobile application, Walmart extends its reach beyond physical store locations, providing customers with convenient access to goods and services. The company’s website features a unique third-party selling feature, allowing external vendors to offer their products through the platform. Walmart conducts its business across multiple platforms, including supermarkets, discount stores, neighbourhood markets, and e-commerce websites, catering to diverse consumer preferences and shopping habits.

Walmart International

Walmart International comprises three main divisions: retailers, wholesalers, and other smaller initiatives. Within these divisions, there are further subdivisions including supermarkets, warehouses, electronics outlets, apparel stores, drugstores, digital retail platforms, and more. This segmentation allows Walmart to cater to diverse market segments and consumer preferences across various regions globally.

Sam’s Club

“Samsclub.com” serves as Walmart’s online platform, specifically catering to members of its warehouse retail operations. This segment encompasses warehouse clubs located across the United States, along with the online platform samsclub.com.

How Walmart Generates Revenue?

Walmart’s revenue model revolves around purchasing products in large quantities at discounted rates from manufacturers, then selling them in smaller quantities at low prices to consumers. This strategy drives high sales volume, resulting in significant earnings.

The company generates revenue by eliminating the middleman and directly selling products to customers, as well as offering services to businesses. Its primary revenue sources include product sales and service offerings.

In the fiscal year ending January 2020, Walmart reported a revenue of $524 billion.

Product Revenue

Walmart offers an extensive array of products across various categories:

- **Grocery**: This category encompasses daily essentials, dairy products, frozen foods, bakery items, baby products, beauty supplies, and more.

- **Health and Wellness**: Walmart provides pharmacy products and clinical services to cater to customers’ health needs.

- **Entertainment**: Products in this category include electronics, toys, cameras, movies, music, videos, and books for leisure and entertainment.

- **Home Improvement**: Walmart offers a range of products such as stationary, paints, hardware, automotive supplies, sporting goods, crafts, and seasonal merchandise to enhance homes and lifestyles.

- **Apparel**: The apparel section features clothing for men, women, boys, and girls, as well as shoes, jewellery, and accessories to meet fashion and style needs.

- **Home Appliances**: Walmart also provides home furnishing services, home decor items, living essentials, and horticulture products to beautify and accessories living spaces.

Service Revenue

Walmart offers a range of revenue-generating services across different sectors:

- **Financial Services**: Walmart provides various financial services such as prepaid cards, money orders, wire transfers, money transfers, and bill payments.

- **VUDU Movie Streaming**: Through VUDU, a subscription-based OTT platform, customers can purchase or rent movies and access on-demand TV shows for entertainment.

- **Clinical Services**: Walmart offers primary healthcare services, physical and wellness checks, as well as clinical lab tests to address customers’ health needs.

- **Health Insurance Services**: Additionally, Walmart provides health insurance services to cater to customers’ healthcare coverage requirements.

Walmart’s Marketing Strategy

Analysing Walmart’s business strategy is crucial for businesses of all sizes, emphasizing the importance of effective marketing plans for survival in the competitive market landscape. Walmart employs a market penetration approach, aiming to capture market share by offering competitive pricing and lower prices to consumers.

The company’s strategy centres around cost leadership, enabling it to generate substantial profits. Walmart prioritises providing low prices to consumers, valuing them as the cornerstone of its market relationship.

Walmart identifies four key factors driving customer retailer choice: price, accessibility, experience, and assortment, aligning its business model to meet these criteria.

Another key driver of Walmart’s success lies in its practice of purchasing products in bulk from local manufacturers and selling them in smaller quantities. This mutually beneficial arrangement fosters job creation, reducing unemployment rates, while also enabling Walmart to offer quality products at competitive prices. Maintaining this approach ensures customer satisfaction and sustained profitability for the company.

Mergers & Acquisitions

Apart from its pricing tactics, Walmart has gained renown for its bold expansion and acquisition manoeuvres. Throughout the 1990s and early 2000s, the company embarked on an acquisition spree, purchasing several prominent retail chains, including Sam’s Club, Asda, and Jet.com.

These acquisitions facilitated Walmart’s entry into new markets and broadened its footprint, yet they were not without hurdles. For instance, Walmart’s acquisition of Asda in the UK faced resistance from both consumers and regulators, resulting in the company having to divest some stores to address competition concerns. Despite these obstacles, Walmart’s acquisition strategy has largely proven successful. For instance, its acquisition of Jet.com in 2016 bolstered its e-commerce capabilities, enhancing its competitiveness against online retail behemoth Amazon.

Acquisition of Jet.com

In 2016, Walmart strategically acquired Jet.com with the aim of enhancing its e-commerce presence and better competing with Amazon. Following the acquisition, Walmart seamlessly integrated Jet.com’s technology and leadership team into its operations, leveraging the platform to broaden its online product offerings.

A significant advantage of this acquisition was the addition of Jet.com founder Marc Lore to Walmart’s executive ranks. Lore, renowned for founding Quidsi (the parent company of Diapers.com and Soap.com) and subsequently selling it to Amazon, brought invaluable e-commerce expertise and a fresh outlook to Walmart.

Under Lore’s stewardship, Walmart has made substantial investments in its online ventures, including acquiring other e-commerce entities like Bonobos and Moosejaw. The acquisition of Jet.com also granted Walmart access to advanced technological tools and data analytics capabilities, empowering the company to enhance its supply chain efficiency and gain deeper insights into customer behavior.

In summary, Walmart’s acquisition of Jet.com has proven largely fruitful, aiding the company in expanding its online revenue streams and better challenging Amazon’s dominance. In its latest financial update, Walmart revealed a notable 69% surge in e-commerce sales, attributed in part to the incorporation of Jet.com’s technology and know-how. Nonetheless, certain analysts have voiced concerns regarding the hefty price tag attached to the acquisition, estimated at approximately $3.3 billion. They question whether Walmart will be able to realise a satisfactory return on investment over the extended term.

Acquisition of Flipkart

Walmart’s purchase of Flipkart, India’s leading e-commerce platform, in 2018 marked a significant step for the retail behemoth to establish itself in one of the globe’s most rapidly expanding retail landscapes. With this acquisition, Walmart secured a substantial 77% ownership stake in Flipkart, investing a staggering $16 billion, thus marking the largest-ever deal in India’s e-commerce history.

Here are some of the key outcomes of the acquisition:

Market Entry: The acquisition provided Walmart with an entry point into India’s burgeoning e-commerce market, anticipated to rank among the largest globally. Flipkart boasts a robust presence in the country, boasting over 200 million registered users and a diverse array of products.

Technological Advancement and Expertise: Flipkart’s advanced technology and deep-seated e-commerce knowledge have empowered Walmart to augment its online capabilities and vie with prominent e-commerce rivals. Flipkart’s platform features innovative functionalities like mobile payment solutions, personalised product recommendations, and sophisticated data analytics, contributing to Walmart’s enhanced customer engagement.

Supply Chain and Logistics Enhancement: Leveraging Flipkart’s robust supply chain and logistics network in India, Walmart has bolstered its delivery and fulfilment capabilities across the region. Walmart has capitalised on Flipkart’s proficiency in critical areas such as last-mile delivery and supply chain automation, fostering operational efficiencies and ensuring smoother logistics operations.

Challenging Amazon: Walmart’s acquisition of Flipkart represented a strategic maneuver to vie with Amazon, which has been rapidly expanding its footprint in India. This acquisition afforded Walmart a substantial entry point into the Indian e-commerce sphere, enabling it to mount a formidable challenge against Amazon’s dominance in the region.

Financial Impact: The integration of Flipkart has positively influenced Walmart’s financial performance in recent years. In fiscal year 2021, Walmart experienced a 1.3% increase in international net sales, propelled in part by robust growth in India facilitated by Flipkart.

In summary, the acquisition of Flipkart has been pivotal for Walmart, facilitating its expansion into the Indian market and positioning it as a key competitor among major e-commerce players. Furthermore, the acquisition has enabled Walmart to enhance its technological capabilities, streamline its logistics and supply chain operations, and bolster its financial standing.

According to eMarketer’s report, as of 2021, Walmart commanded a 9.3% share of the global retail market, surpassing Amazon’s 2.3% share and Costco’s 1.6% share.

SWOT Analysis of Walmart

Walmart Strengths

Brand recognition – With its vast customer base frequenting Walmart outlets daily, the retail giant stands as the most renowned retail brand worldwide. Offering over 60 million items online, Walmart boasts significant visibility and impact. Forbes Global 2000 ranks Walmart as the 19th largest company globally, with staggering revenues of $524.40 Billion for FY2020.

Global expansion – Recent acquisitions of ASDA in the UK and Flipkart in India, along with a partnership with Bharti in India’s retail sector, have bolstered Walmart’s global footprint, proving fruitful ventures for the company.

Global presence – With operations spanning 27 countries through 11,484 stores and clubs under its Walmart U.S., Walmart International, and Sam’s Club segments, Walmart operates under 56 different names worldwide, strengthening its global influence and revenue streams.

‘Every Day Low Prices’ strategy – Rooted in economies of scale, Walmart’s pricing strategy leverages fixed costs across its vast array of products, making it a global destination for affordable shopping.

Global supply chain and logistics system – Walmart’s core competencies lie in its robust distribution and logistics systems, supported by Information Technology (IT) to monitor product performance across stores and countries efficiently.

Human Resource Management – Walmart invests substantially in its workforce, recognizing employees as key assets, with 1% of America’s workforce employed by Walmart, according to Business Insider.

Effective resource management – Walmart excels in managing resources like information systems, supply chains, distribution facilities, and skills across its operations worldwide.

Strong market power over suppliers and competitors – Walmart’s sheer size and global reach afford it significant leverage over suppliers and competitors, consolidating its market dominance.

Effective adoption of e-commerce – In response to shifting consumer habits, Walmart has strengthened its e-commerce channels, leading to a surge in online sales alongside traditional in-store revenue, propelling overall sales to unprecedented heights in Q1 and Q2 of 2020.

Walmart Weaknesses

Employee treatment and working conditions – Walmart has faced repeated criticism and legal challenges regarding its treatment of employees. Issues such as low wages, inadequate healthcare, and substandard working conditions have drawn public scrutiny.

Large span of control – Walmart’s immense size and extensive control over its operations may result in vulnerabilities in certain areas.

Thin profit margins – Walmart’s commitment to a cost leadership strategy often translates into slim profit margins for the company.

Gender discrimination – Walmart has been embroiled in lawsuits, including a 2007 case alleging gender discrimination in job opportunities, promotions, and pay scales for female employees.

Imitation – Walmart’s business model lacks distinct competitive advantages, making it susceptible to imitation by rivals, albeit without possessing unique attributes beyond its sheer scale.

Racially discriminatory practices – Walmart faced backlash during racial inequality protests in June 2020, particularly regarding the practice of locking multi-cultural hair care products behind glass while leaving products for white consumers accessible. Though this policy was discontinued, concerns persist among people of color.

Employee safety concerns – Walmart has faced legal action for allegedly neglecting safety protocols during the recent health crisis, resulting in the deaths of two employees.

Overdependence on the US market – Despite its global presence, Walmart’s significant reliance on the US market, where the majority of its stores are located and the bulk of its sales originate, poses a risk to its diversification strategy.

Negative publicity – Walmart’s reputation suffered from allegations of bribery involving foreign officials in countries such as Mexico and China. In 2019, the company agreed to a $282 million settlement to resolve the bribery case.

Walmart Opportunities

Expansion into new markets – Walmart has the potential to tap into untapped markets such as China, the Middle East, and Latin America, presenting lucrative opportunities for growth.

Strategic partnerships – Walmart can explore strategic alliances with major corporations or merge with global retailers. Additionally, acquiring smaller companies can provide avenues for expansion and profitability.

Enhanced human resource practices – Innovating in human resource management can yield significant benefits for Walmart, given its reliance on its workforce. Implementing advanced HR practices can optimise employee performance and satisfaction.

Improving product quality standards – Addressing concerns about product quality associated with low-cost offerings presents an opportunity for Walmart to enhance its reputation and meet evolving consumer expectations for healthier and safer products.

Boosting online sales – With the surge in online shopping, Walmart can capitalise on this trend by strengthening its e-commerce platforms. The recent investment in Flipkart underscores Walmart’s commitment to expanding its online presence.

Expanding healthcare services – Leveraging its existing involvement in healthcare, Walmart can seize opportunities in the healthcare sector by expanding its services. Initiatives like Walmart Insurance Services LLC demonstrate the company’s ambition to diversify and meet growing consumer needs in healthcare.

Walmart’s Threats

Impeach 45 Controversy – Walmart faced scrutiny over the sale of T-shirts featuring the slogan “Impeach 45” and another print reading ‘Rope. Tree. Journalist. Some Assembly Required.’ These shirts, seen as potentially endorsing violence, sparked controversy. Walmart, however, distanced itself from the issue, stating that the T-shirts were sold by third-party vendors on its Marketplace platform rather than directly by Walmart.

Fake craft beer controversy – In 2017, Walmart came under fire for allegedly selling fake craft beer labelled as ‘Trouble Brewery,’ purportedly from a non-existent production company. Although produced by WX Brands, the mislabeling raised concerns about deceptive marketing practices.

Intense competition – As the world’s largest grocery retailer, Walmart faces fierce competition, particularly from rivals like Target and Costco. These competitors offer comparable products, often with perceived higher quality, and maintain better reputations for employee treatment. They also garner significant public support in these areas.

Political and legal challenges – Walmart’s operations are subject to political and legal complexities, potentially impeding its activities in certain regions or countries.

Emergence of small-scale online retailers – The rise of numerous small-scale and independent online sellers poses a threat to Walmart’s market position, offering similar products at competitive prices through their own websites.

Website technical issues – Customers have reported various technical glitches on Walmart’s website, including disorganised product listings and slow performance. In contrast, competitors like Amazon are known for their efficient and user-friendly online platforms, providing superior shopping experiences.

Economic instability – Like any retailer, Walmart is vulnerable to economic downturns, with fluctuations in consumer spending impacting its sales and profitability.

Trade tensions – Operating in 28 countries, including 438 stores in China as of January 2020, Walmart is exposed to trade tensions, particularly between China and the US, which could affect its global operations due to tariffs and trade restrictions.

Conclusion

In summary, Walmart started small but grew into the biggest retailer worldwide. It’s known everywhere, has stores all over, and focuses on low prices and good supply chains. Still, Walmart gets criticized for how it treats workers, product quality, and ethics. It also faces tough competition, tech problems, economic ups and downs, and global tensions. Despite all this, Walmart keeps going strong. It’s always changing and improving, using its big resources and market power. So, it looks set to keep leading the retail world for a long time.