PayPal Case Study

Introduction:

PayPal Holdings, Inc. is a U.S.-based multinational fintech company that provides an online payments system used in most countries where online money transfers are supported. It offers a digital alternative to traditional paper methods like checks and money orders. PayPal functions as a payment processor for online vendors, auction sites, and various commercial users, charging a fee for its services.

Founded in 1998 as Confinity, PayPal went public in 2002 and was acquired by eBay later that year for $1.5 billion. In 2015, eBay spun off PayPal, making it an independent company again. PayPal was ranked 143rd on the 2022 Fortune 500 list of the largest U.S. corporations by revenue and has been a member of the MACH Alliance since 2023.

History

Early history

The company was started by Max Levchin, Peter Thiel, and Luke Nosek in December 1998 as Fieldlink, which was later renamed Confinity. Initially, it developed security software for handheld devices but shifted to creating a digital wallet after the original business model failed. The first version of the PayPal electronic payments system launched in 1999.

In March 2000, Confinity merged with X.com, an online financial services company founded by Elon Musk, Harris Fricker, Christopher Payne, and Ed Ho in March 1999. Musk believed in the future of Confinity’s money transfer business. However, he and X.com’s president and CEO, Bill Harris, disagreed on its potential, leading to Harris’s departure in May 2000. By October, Musk decided to focus X.com solely on payments, and later that month, Peter Thiel replaced Musk as CEO. The company was renamed PayPal in June 2001 and went public in 2002. PayPal’s IPO was listed under the ticker PYPL at $13 per share, raising over $61 million.

eBay subsidiary (2002–2014)

Shortly after its IPO, PayPal was acquired by eBay on October 3, 2002, for $1.5 billion in eBay stock. PayPal quickly became the primary payment method for eBay users, accepted by over 70% of auctions and used in 25% of transactions.

In 2005, PayPal acquired VeriSign’s payment solution for enhanced security. In 2007, it partnered with MasterCard to launch the PayPal Secure Card, enabling payments on websites that didn’t accept PayPal. By the end of 2007, PayPal’s revenue reached $1.8 billion.

In 2008, PayPal acquired Fraud Sciences and Bill Me Later, expanding its online risk tools and credit services. By 2010, PayPal had over 100 million active accounts in 190 markets with 25 currencies. In 2011, members of the Anonymous group were charged with disrupting PayPal after it stopped processing WikiLeaks donations, and by 2013, thirteen pleaded guilty.

PayPal grew its Merchant Services division for eBay retailers and announced plans to enable in-store payments. In 2012, it partnered with Discover Card to allow payments at seven million stores. By the end of 2012, PayPal processed $145 billion in payments, contributing 40% to eBay’s revenue.

In 2013, PayPal acquired IronPearl and Braintree to boost product development and mobile services. In June 2014, David Marcus left as President, succeeded by Dan Schulman, former CEO of Virgin Mobile and EVP of American Express.

Spin-off from eBay (2014–present)

On September 30, 2014, eBay announced it would spin off PayPal into a separate public company, influenced by activist investor Carl Icahn. The separation was completed on July 18, 2015, with Dan Schulman as CEO and John Donahoe as chairman. eBay later announced that after their agreement ended in 2020, PayPal would no longer be featured prominently on eBay, which would instead work with Adyen for payment processing.

In July 2015, PayPal acquired Xoom Corporation for $1.09 billion to strengthen its international business. In September 2015, PayPal launched PayPal.Me, a peer-to-peer payment platform available in 18 countries. By May 2018, PayPal agreed to buy Swedish payment processor iZettle for $2.2 billion, its largest acquisition at the time.

In March 2019, PayPal partnered with Instagram on its “Checkout on Instagram” feature. In June 2019, COO Bill Ready announced he would leave by the end of the year. In October 2019, PayPal reported a $228 million loss, primarily from a $500 million investment in Uber.

In January 2020, PayPal acquired Honey for over $4 billion. In June 2020, it committed $530 million to support Black-owned businesses and minority communities. In January 2021, PayPal became the first foreign company to fully control a payment platform in China.

In March 2021, PayPal was ranked as the second most trusted global brand. In June 2022, Shopify partnered with PayPal to offer Shopify Payments in France. In February 2023, PayPal announced layoffs for 2,000 workers, or 7% of its workforce. CEO Dan Schulman announced he would step down by the end of 2023, with Alex Chriss named as his successor effective September 27, 2023.

In August 2023, PayPal launched a U.S. dollar stablecoin, PayPal USD (PYUSD). In November 2023, the SEC launched a legal investigation into PayPal and Paxos regarding the stablecoin. In October 2023, PayPal sold its reverse logistics subsidiary, Happy Returns, to UPS.

In 2024, PayPal announced plans to revive growth in its branded checkout products amid increased competition and revised its full-year profit forecast upwards.

Finances

PayPal’s fiscal year runs from January 1 to December 31. In fiscal year 2019, PayPal reported earnings of $2.459 billion and an annual revenue of $17.772 billion, marking a 15% increase from the previous year. In December 2019, PayPal’s shares were trading at over $108 each, with a market capitalization exceeding $127.58 billion.

The COVID-19 pandemic has accelerated the adoption of digital payment platforms like PayPal, reducing the reliance on traditional banking. Consequently, PayPal’s stock price rose by up to 78% in 2020 as of October, and its total payment volume increased by 29% to $220 billion, boosting investor confidence.

During the pandemic from 2020 to 2022, PayPal laid off hundreds of workers in the US and shifted jobs overseas.

Year | Revenue | Net income | Total Assets | Price per Share | Employees |

2012 | 5,662 | 778 |

|

|

|

2013 | 6,727 | 955 | 19,160 |

|

|

2014 | 8,025 | 419 | 21,917 |

|

|

2015 | 9,248 | 1,228 | 28,881 |

| 16,800 |

2016 | 10,842 | 1,401 | 33,103 | 39.47 | 18,100 |

2017 | 13,094 | 1,795 | 40,774 | 73.62 | 18,700 |

2018 | 15,451 | 2,057 | 43,332 | 84.09 | 21,800 |

2019 | 17,772 | 2,459 | 51,333 | 108.17 | 23,200 |

2020 | 21,454 | 4,202 | 70,379 | 234.20 | 26,500 |

2021 | 25,371 | 4,169 | 75,803 | 188.58 | 30,900 |

2022 | 27,518 | 2,419 | 78,717 | 71.22 | 29,900 |

2023 | 29,771 | 4,246 | 82,166 | 61.41 | 27,200 |

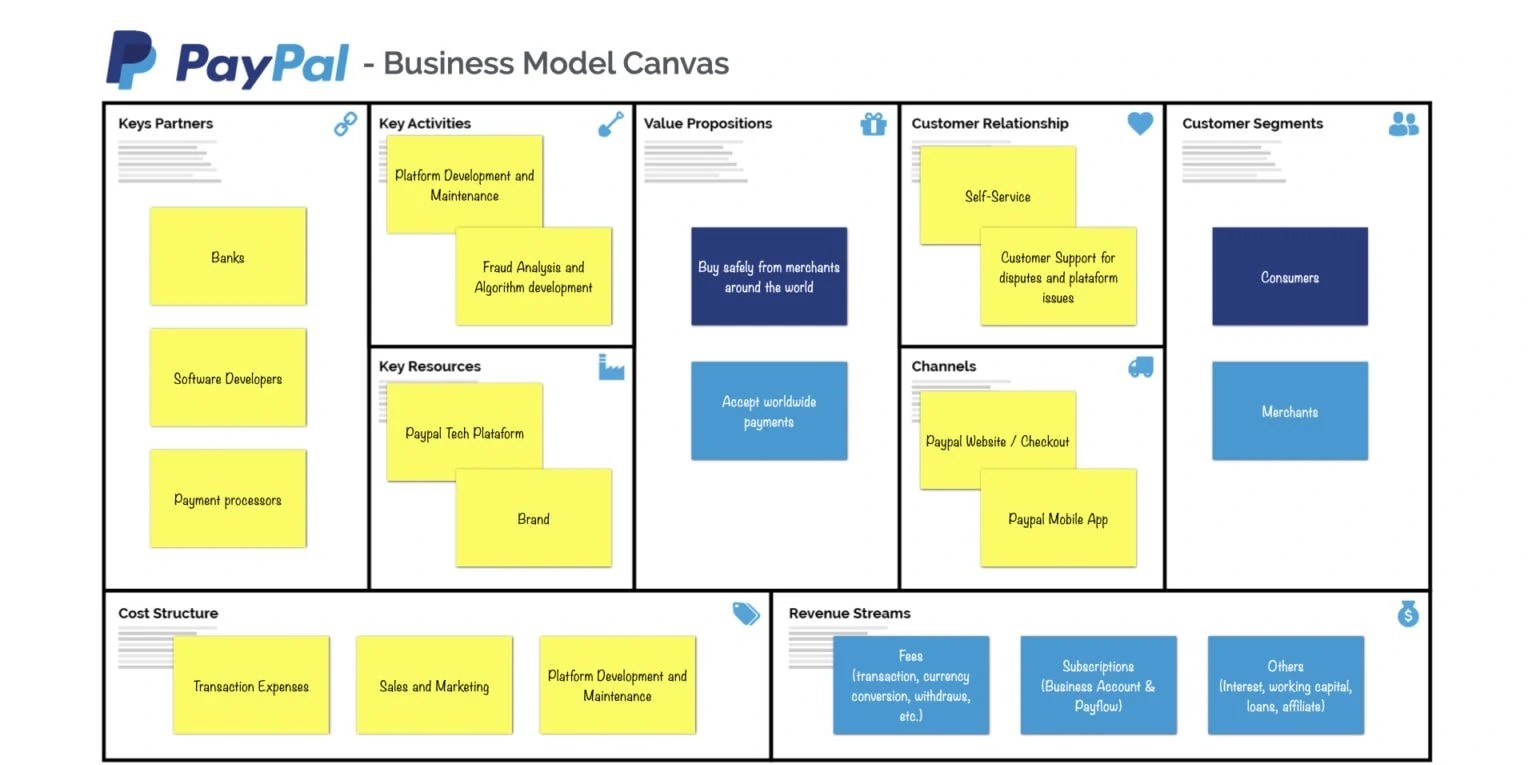

PayPal Business Model

PayPal’s business model is based on fintech and operates as a classic two-sided platform. On one side are merchants, the businesses that use PayPal for secure and trusted financial transactions. On the other side are consumers, primarily individuals, who make payments through PayPal on merchants’ websites. In the past, sending money overseas was a significant challenge, but PayPal revolutionized the process by making transactions simpler and cheaper than traditional banks and financial companies. Today, PayPal operates in over 200 countries and has more than 300 million users worldwide. Let’s explore how PayPal’s business model has achieved such substantial growth over the years.

PayPal’s Customer Segments

As PayPal is a two-sided platform, there are two customer segments, consumers and merchants. Consumers are the individuals who shop, send and receive money. Merchants are the businesses that accept payments, both online and offline.

PayPal’s Value Propositions

PayPal’s value propositions are:

- Convenience

- Security

- A trustful brand

- Global scale

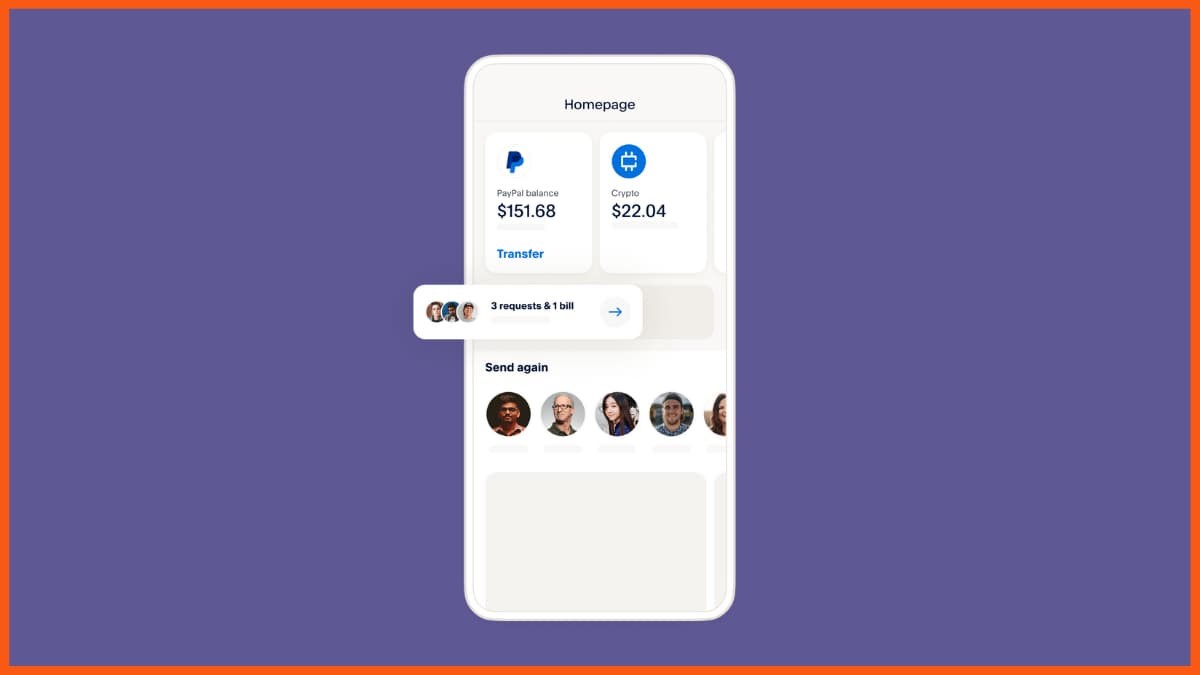

PayPal’s Channels

The primary channel for PayPal is its website, where most customer transactions occur. Additionally, PayPal offers a mobile app and operates two mobile payment subsidiaries, Venmo and Xoom.

PayPal’s Customer Relationships

PayPal primarily operates on a self-service model, requiring little direct interaction with its team. However, the company employs over 8,000 customer service representatives. Additionally, PayPal provides Buyer and Seller Protection Programs to ensure satisfaction and confidence for both parties involved in transactions.

PayPal’s Revenue Streams

The primary revenue streams for PayPal are transaction fees, but there are additional sources of income as well. These will be detailed in the next section, which discusses PayPal’s various income sources.

PayPal’s Key Resources

PayPal’s key resources include:

- Its global technology platform

- Bank financing

- Human resources

PayPal’s Key Activities

PayPal’s key activities can be described as the three parties that mainly require platform management: consumers, merchants, and banks — both for its website and mobile app.

PayPal’s Key Partners

PayPal’s key partners include:

- Banks

- Payment processors

- Software developers

PayPal’s Cost Structure

In terms of its cost structure, PayPal operates on a cost-driven model, with its most significant expenses attributed to transaction costs. Additionally, the company incurs expenses related to customer support, sales and marketing, product development, operations, and general administrative costs.

PayPal’s Competitors

- Google Pay, formerly known as Google Wallet, is a payment system enabling users to wirelessly pay with their Android smartphones equipped with NFC technology, provided the debit/credit card is properly registered. Additionally, it facilitates money requests and transfers within the app, positioning itself as a key rival to PayPal.

- Apple Pay operates through the Wallet app, allowing users to make payments using their iPhones, as long as the associated debit/credit card is registered. It extends its functionality to iPad, Apple Watch, and recent models of Apple computers.

- WePay, established in 2008 and supported by JPMorgan Chase, offers financial services to business platforms and earns revenue through service fees during fund processing.

- 2Checkout, founded in 2000, stands as a primary competitor in electronic payment services. Serving as an all-in-one monetization platform, it empowers business clients to swiftly expand internationally.

- Net, launched in 1996 and now a Visa subsidiary, is a leading competitor with the largest customer base in the payment services market. Catering to small and medium-sized merchants, it also provides API and software development kits for Android and iOS systems.

- Stripe, headquartered in San Francisco, California, and Dublin, Ireland, is a prominent competitor offering financial services and Software as a Service (SaaS) solutions globally to business clients.

PayPal – Target Market

PayPal serves as a digital payment platform catering to a diverse array of users, encompassing individuals, businesses, and freelancers. With its services tailored to meet the needs of a broad customer base, PayPal offers a secure and convenient online transaction experience.

The platform primarily targets individuals who engage in regular online transactions, including e-commerce shoppers, freelancers, and those in the gig economy. It holds particular appeal for millennials and Gen Z users, who display a preference for digital payment methods.

While PayPal’s audience spans across various demographics, its core demographic comprises users aged 18 to 34, who form a significant portion of its user base. This demographic tends to be more technologically adept and familiar with digital payment platforms.

PayPal’s reach extends globally, with availability in over 200 markets worldwide, ensuring accessibility to users across the globe. Its services are especially popular in key markets like the United States, the United Kingdom, and Australia.

Factors such as online shopping behaviours, frequency of transactions, and the desire for secure payment methods influence PayPal’s appeal to its target audience. The platform’s commitment to security and convenience, coupled with its global presence, positions it as a trusted and accessible choice for individuals seeking a reliable online transaction solution.

PayPal – Marketing Mix

PayPal has revolutionised the payment landscape with its digital platform, marking a departure from traditional methods. Its achievement stems from a well-crafted marketing strategy, blending product innovation, competitive pricing, effective promotion, and strategic placement to deliver a streamlined user journey.

Product

This aspect of PayPal’s marketing strategy revolves around its digital payment offerings, enabling users to conduct secure online transactions. In addition to basic payment capabilities, the platform provides various supplementary features such as buyer and seller protection, currency conversion, and seamless integration with leading e-commerce platforms. These added functionalities enhance the core product, increasing its appeal to users.

Price

Another vital component of PayPal’s marketing strategy is its pricing structure. The platform levies charges for its services, usually based on a percentage of the transaction value. Nonetheless, PayPal maintains competitive pricing, often offering lower fees compared to conventional payment processors. This pricing approach has been instrumental in PayPal’s ability to stay competitive and draw in a substantial user base.

Promotion

This aspect encompasses the array of channels employed by the company to engage its intended audience. PayPal’s promotional endeavours encompass digital advertising, social media engagement, and email campaigns. Additionally, the company collaborates with well-known brands and e-commerce platforms to enhance its visibility and expand its user base.

Place

PayPal operates in over 200 global markets, accessible via its website and mobile application. Additionally, it collaborates with banks and financial institutions to extend its services to their clientele. The success of PayPal owes much to its well-rounded marketing approach, emphasizing product quality, competitive pricing, effective promotion, and strategic placement. This approach has facilitated a user-friendly experience, fostering a sizable user community and sustaining competitiveness in a competitive market landscape. As digital payments gain traction, PayPal’s marketing strategy is poised to adapt to evolving user preferences, ensuring its continued leadership in the industry.

PayPal – Marketing Strategies

PayPal stands out as a premier digital payments platform that has revolutionised the landscape of financial transactions. Its prominence owes much to its adept marketing strategies, which have not only drawn in a significant user base but also ensured its competitive edge. Let’s delve into the key marketing strategies that have propelled PayPal into the realm of household recognition.

Focus On User Experience

At the core of PayPal’s marketing approach lies its dedication to delivering an exceptional user experience. The platform prioritises simplicity, ensuring a smooth and hassle-free interface for users. Its swift transaction processing and commitment to outstanding customer service further bolster its appeal, attracting and retaining a loyal user base.

Partner With Popular Brands

PayPal has forged strategic alliances with well-known brands like eBay, Airbnb, and Uber to enhance its exposure and expand its user base.

Embrace Social Media

PayPal maintains a robust presence on various social media platforms like Facebook, Twitter, and Instagram. Utilising these channels, the platform actively interacts with its audience, offers customer assistance, and showcases its offerings to drive engagement and awareness.

Offer Incentives

PayPal incentivizes users to utilise its platform by providing rewards. For instance, the company offers cash-back incentives for utilising its PayPal Credit service.

Expand Globally

PayPal has expanded its services to over 200 markets worldwide, making it a global leader in digital payments.

Offer Flexible Payment Options

PayPal’s marketing approach highlights its flexibility in payment methods. Users have the freedom to pay using their PayPal balance, credit/debit cards, or directly from their bank accounts.

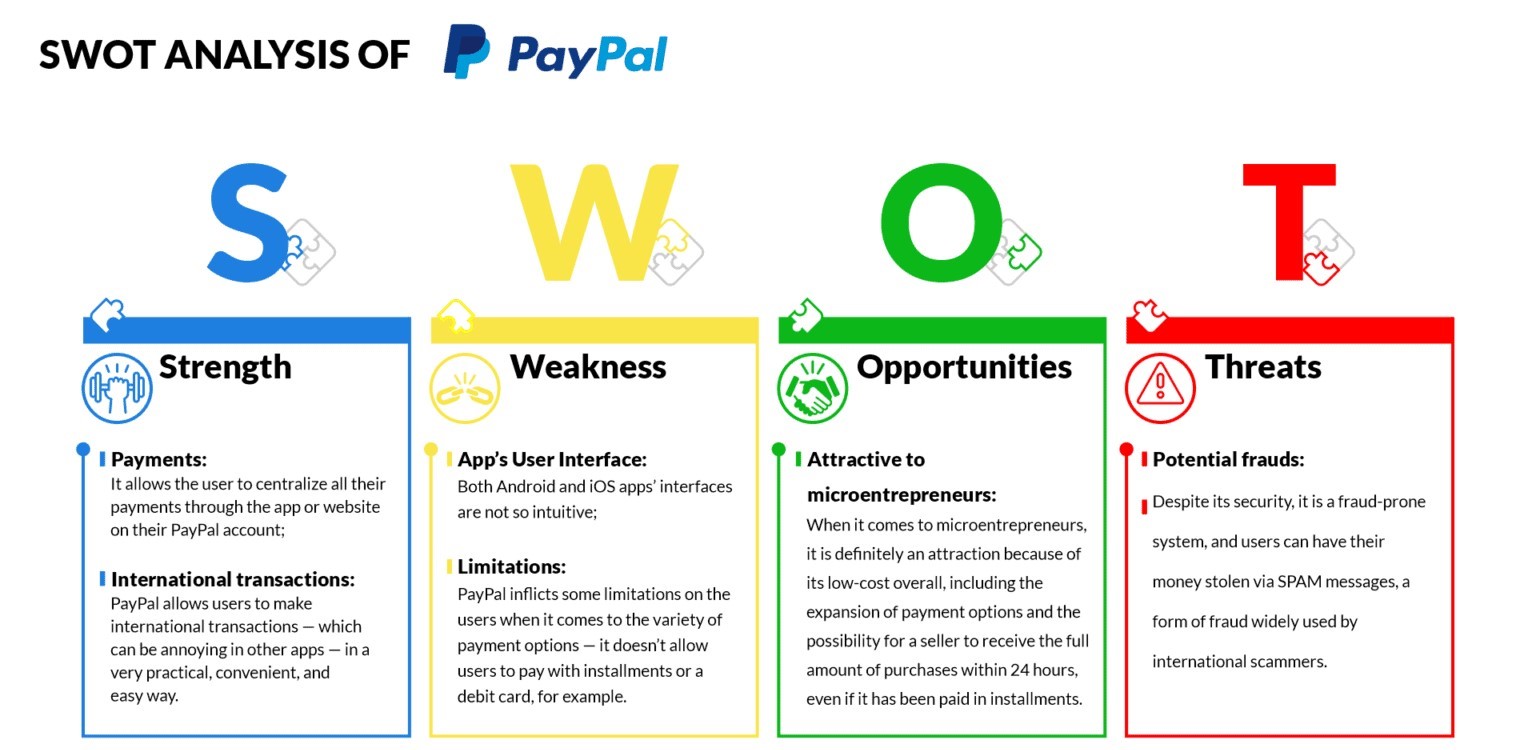

PayPal’s SWOT Analysis

PayPal’s Strengths

- Payments: PayPal enables users to consolidate all their payments through its app or website, streamlining transactions within their PayPal account.

- International transactions: Unlike other platforms, PayPal simplifies international transactions, offering a practical, convenient, and straightforward process for users.

PayPal’s Weaknesses

- App User Interface: The interfaces of both the Android and iOS apps are considered less user-friendly.

- Limitations: PayPal imposes restrictions on users regarding payment options. For instance, it does not support instalment payments or payments made with a debit card.

PayPal’s Opportunities

- Appealing to Micro-Entrepreneurs: For small-scale business owners, PayPal holds significant allure due to its overall affordability, encompassing expanded payment choices and the capability for sellers to receive the full purchase amount within 24 hours, even for instalment payments.

PayPal’s Threats

- Risk of Fraud: Despite its robust security measures, PayPal is susceptible to fraudulent activities. Users may fall victim to scams, including phishing emails, commonly employed by international fraudsters to steal money.

Conclusion

In conclusion, PayPal remains one of the leading and effective financial instruments in the realm of online payment solutions. Its services cater to businesses and clients worldwide, facilitating international transactions involving various currencies, all accessible through its website or mobile application.